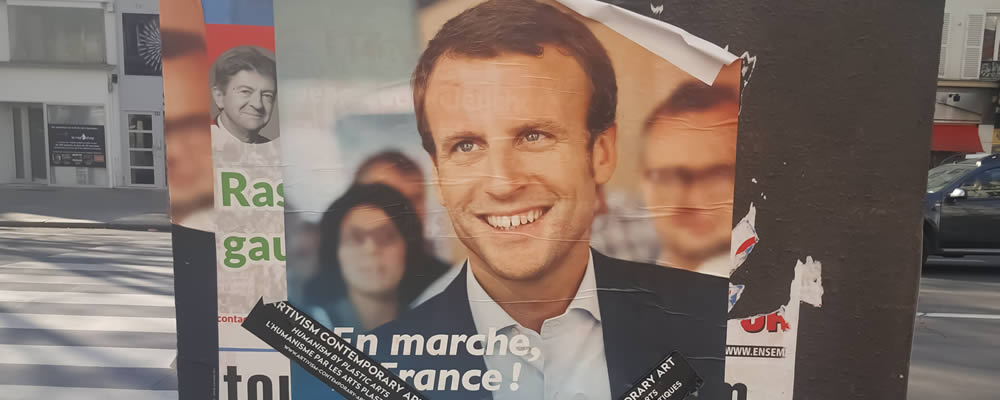

The Euro US Dollar exchange rate has retained Monday’s momentum, caused by Emmanuel Macron reaching the French presidential election final.

- EUR USD rate remains at 1.08 after French election boost – USD EUR dips to 0.91

- French confidence hits record high – Best score since Eurozone crisis

- US Dollar drops after Fed’s Kashkari’s speech – Infrastructure dismissal goes against Trump spending plans

- Further French confidence data ahead – USD losses possible on home sales stats

As well as the election news, the Euro has also been aided by an unexpected rise in French business confidence during April.

The new figure of 108 points puts confidence at the highest level since the Eurozone crisis of mid-2011, which shows that businesses are so far unfazed by the French election’s potential outcome.

The biggest US news on Monday was a speech by Fed official Neel Kashkari. Going against Donald Trump’s much-touted ‘trillion Dollar’ spend on infrastructure, Kashkari stated;

‘I don’t see infrastructure holding back our economic growth’.

Eurozone confidence will remain a strong influence on the Euro in the near-term, with Wednesday and Thursday bringing French and German consumer confidence scores. The French figure for April is not expected to change, while a slight German sentiment increase is predicted in May.

Other notable news on Thursday will be Eurozone confidence stats, German inflation and the European Central Bank (ECB) interest rate decision.

The ECB is expected to leave interest rates on hold, but German inflation may boost the Euro if it rises as forecast.

The US Dollar, meanwhile, may remain weak when March new home sales figures come out. Forecasts are for a -0.8% drop on the month, which could further hinder a US Dollar to Euro recovery.

Looking further ahead, Wednesday could be turbulent for the US Dollar thanks to two Trump-based events.

The first will be a briefing for the entire US Senate about North Korea, which may lead to a later announcement from President Trump on the situation.

North Korean missile tests and supposedly increased nuclear capabilities could push Trump into declaring action against the East Asian regime.

Trump is also expected to make a ‘big tax reform and tax reduction’ announcement on Wednesday or Thursday. Although this sounds like a significant step for Trump’s policy plans, White House officials have downplayed the news;

‘[The President] will be outlining principles for tax reform’.

Even if the plans are only for minor changes, they could still cause a significant US Dollar drop if they appear unfeasible or overly ambitious.

Current Interbank EUR USD Exchange Rates

At the time of writing, the Euro to US Dollar (EUR USD) exchange rate was trading at 1.08 and the US Dollar to Euro (USD EUR) exchange rate was trading at 0.91.