- Euro Exchange Rates Held Back by Political Jitters – French election draws near

- Forecast: Eurozone Inflation Data Due this Week – Could alter ECB tightening bets

Euro Exchange Rates Limp on Monday and Tuesday

Amid a lack of fresh supportive news for the Euro, Euro exchange rates saw mixed performance on Monday and Tuesday after markets opened this week.

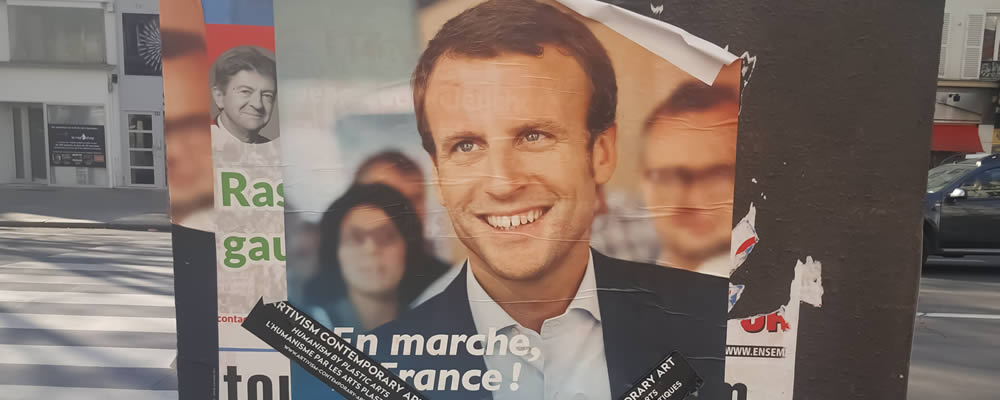

French Presidential election jitters have continued to worsen and the polling differences between the first round’s four frontrunners have thinned. Anti-EU Marine Le Pen and Pro-EU Emmanuel Macron remain the favourites to win the first round.

The Euro to Pound exchange rate plunged on Tuesday when UK Prime Minister Theresa May shocked markets by announcing that a UK general election would be held on the 8th of June. Investors hoped May would increase the Conservative party’s Parliamentary mandate to make the Brexit process smoother.

Meanwhile, the Euro to US Dollar exchange rate advanced on both Monday and Tuesday to hit its best levels since March, as geopolitical jitters weighed on the US Dollar.

[Published 06:00 BST 17/04/2017]

Euro (EUR) exchange rates saw mixed movement last week. A lack of highly influential data published throughout the week, as well as rising Eurozone political jitters, prevented it from holding its ground against some major currency rivals.

The shared currency was able to advance slightly against the US Dollar last week, rising from 1.05 to 1.06. However, the Euro recorded losses against the Pound and Australian Dollar last week (among others).

The latest Eurozone and German economic sentiment surveys from ZEW came in well above expectations and Germany’s March inflation results met projections at 0.2% monthly and 1.6% yearly.

However, with April half-way over and the first round of the 2017 French election set to begin in the coming week, political concerns are weighing heavily on demand for the single currency.

Fears that France could be withdrawn from the Eurozone have risen in the last week. Anti-EU candidate Marine Le Pen remains a favourite to win the first round and now far-left Jean-Luc Melenchon, who is also Eurosceptic, has seen a surge in popularity.

While analysts still expect pro-EU centrist candidate Emmanuel Macron to win the second round, the perceived possibility of a Frexit has risen as a result of Melenchon’s popularity surge.

Euro (EUR) Could Strengthen Next Week if Inflation Data Impresses

Wednesday will see the publication of the Eurozone’s March Consumer Price Index (CPI) results. Recent Eurozone inflation data hasn’t been quite as strong as markets hoped, which prompted European Central Bank (ECB) officials to reiterate a cautious tone earlier in the month.

If the Eurozone’s final March inflation stats beat expectations, demand for the Euro could increase slightly and some analysts will likely suggest that the ECB could begin to hint at tighter monetary policy in the mid to long-term.

Later in the week, other influential Eurozone datasets will be published -including April’s Eurozone consumer confidence report and Markit’s April PMI projections for the bloc.

However, even if these reports impress, investors may overlook them due to Eurozone political jitters and the imminence of the French Presidential election.

French Presidential Election: First Round Begins on 23/04

Regardless of how opinion polls shift and Eurozone data prints in the coming week, the Euro is unlikely to put on a strong performance with the first round of France’s Presidential election beginning this coming Sunday.

The shared currency is likely to be jittery throughout the week as analysts and betting markets attempt to get a hold on what the most likely outcomes of the election could be.

On Sunday the 23rd of April, French citizens will take to the polls to vote for the two Presidential candidates that will go on to the second, final round. The second round of the election will take place on the 7th of May and will see the top two picks go face-to-face in a one-on-one polling battle.

The last few weeks have seen the highly unpredictable French Presidential race fall on four potential winners.

As of last week’s opinion polls, far-right anti-EU candidate Marine Le Pen and centrist pro-EU candidate Emmanuel Macron remain the voters’ favourites in the first round, making them the most likely to head to the final.

However conservative pro-EU Francois Fillon and far-left Eurosceptic Jean-Luc Melenchon aren’t too far behind. If last year’s Brexit and Trump votes taught markets anything, it’s that final results can be quite different from those shown in opinion polls.

If Macron and Le Pen make it to round two as analysts predict, most polls suggest Macron will deliver a clean victory overall in a one-on-one.

On the other hand; in the possibility both Eurosceptic candidates, Le Pen and Melenchon, make it to the final round, the Euro could see massive losses next week and bets of a Frexit will soar.

This possibility will keep Euro traders on their toes this week and Euro (EUR) exchange rates are unlikely to full capitalise on any strong domestic data as a result.