- Pound Euro 2017 Exchange Rate Slips – GBP EUR remains above 1.15

- Brexit Speech Impresses – Likely to be primary GBP influence this week

- EUR Forecast: European Central Bank Meeting Ahead – Analysts anticipate Mario Draghi press conference

Pound Euro 2017 Exchange Rate Sold from Highs on Wednesday

Despite being sold throughout Wednesday’s session, the Pound Euro 2017 exchange rate remained well above the week’s opening levels and looked to end Thursday’s European session comfortably above the level of 1.15.

Solid Eurozone Consumer Price Index (CPI) figures published in the morning offered the Euro some support, but it failed to hold GBP EUR down at the level of 1.14.

This was due to the afternoon’s news that the UK Supreme Court would finally make its judgement on the UK government’s legal battle with the High Court on the 24th of January – next Tuesday.

With markets hoping the Supreme Court will uphold the High Court’s decision that Brexit must begin through an act of Parliament, Sterling’s losses were softened.

[Previously updated 12:44 GMT 18/01/2017]

The Pound Euro 2017 exchange rate plunged on Wednesday morning and by the early afternoon had fallen below the level of 1.15 once again.

Sterling sentiment remained decent, but investors sold it from its highest levels following its highly bullish Tuesday, indulging in profit-taking stances.

GBP trade was also slightly jittery due to comments made by Scotland’s First Minister Nicola Sturgeon. Sturgeon stated following May’s Tuesday speech that the case for Scotland holding a second independence referendum was now higher.

The possibility of Scotland leaving the Pound is a considerable long-term destabilizing factor to Sterling.

[Previously updated 16:53 GMT 17/01/2017]

Pound Euro 2017 Exchange Rate Leaps to Weekly High after Brexit Speech

Investors poured into the Pound Euro 2017 exchange rate on Tuesday afternoon as the day’s Brexit speech from UK Prime Minister Theresa May impressed markets.

GBP EUR surged to the level of 1.15 and was up over 1.7% towards the end of Tuesday’s European session. However, some analysts believe the Pound will fall again despite today’s optimism, as uncertainty about the Brexit process remains high.

The Euro saw little influence from the day’s ZEW economic sentiment surveys. Germany’ ZEW survey failed to meet forecasts, instead coming in at 16.6. The Eurozone’s overall economic sentiment improved to a solid 23.2 however.

[Previously updated 12:31 GMT 17/01/2017]

Tuesday’s Brexit speech from UK Prime Minister Theresa May initially had a strong upside effect on the Pound Euro 2017 exchange rate. At the time of writing, May’s speech was ongoing and GBP EUR trended over 0.8% higher – above the level of 1.14.

This is largely due to May’s reconfirmation that there would be a Parliament vote for the final Brexit deal before it enters law at the end of negotiations.

GBP trended optimistically following the comments despite confirmation from May that the UK would not be seeking full single market access as part of Brexit negotiations.

[Previously updated 9:24 GMT 17/01/2017]

The Pound Euro 2017 exchange rate fell to a new 2017 low on Monday, trending a cent below the weekend’s level of 1.14 after briefly hitting 1.12.

The biggest influence for GBP EUR exchange rate movement was the market’s fading hope that UK Prime Minister Theresa May would propose the UK remains in the EU single market following the Brexit, ahead of her anticipated Brexit speech today.

Concerns relating to a loss of access to the single market also saw the Pound hit its worst levels of the year so far against rivals like the US Dollar, Australian Dollar and New Zealand Dollar.

While Sterling did edge slightly higher before the close of the European session, the expectation that the Pound could fall further today is still high.

According to currency analyst Josh Ferry Woodard; ‘Almost all signs point to a ruthless speech from the UK PM, and we can expect heavy Sterling pressure if fears of a ‘hard Brexit’ are finally made explicit. On the other hand, an unlikely softening in approach from May could actually kick-start a mini GBP/EUR revival.’

Pound (GBP) Slumps on Thinning Single Market Hopes

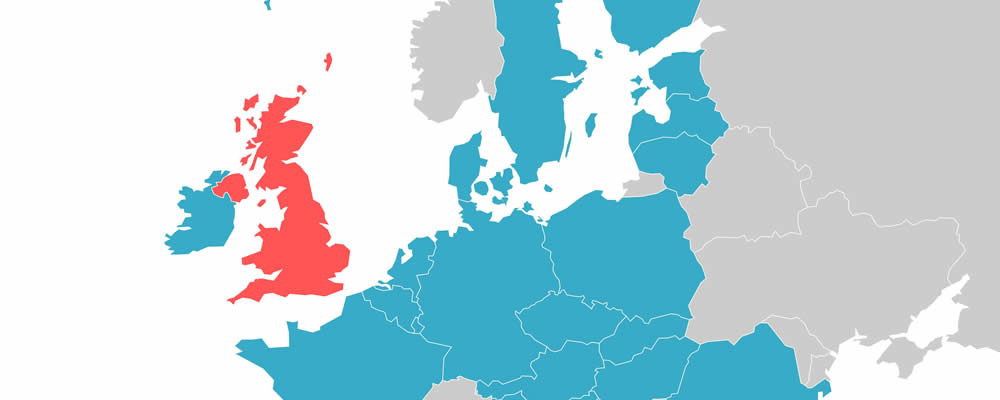

Most of the Pound appreciation in recent months has been due to hopes that the UK government will fight for full access to the EU single market following the Brexit.

However, analysts have suggested Sterling may fall back towards its post-Brexit lows in the coming months on worsening investor fears that the UK will lose most of its major trade links during the Brexit process.

In recent weeks, the UK government and Prime Minister Theresa May have played down the possibility of maintaining full single market access, leaving Sterling with far lower appeal.

May is expected to state in her Brexit speech that the UK government will withdraw from the single market in favour of increased immigration controls.

However, some analysts have reminded that, despite criticisms of uncertainty, May’s stance has actually not changed much. Kallum Pickering from Berenberg stated the recent position from the UK government is nothing new;

‘While the Prime Minister hasn’t gone so far as to plainly state the potential impacts of such an arrangement, her broad aims for post-EU Britain have been consistently clear for some time now. The commonly heard ‘uncertainty’ about May’s intentions is hard to justify. Unless May does a complete U-turn from here, any hope of full single market access for post-EU Britain is more or less out of the question.’

Despite analysts being unsurprised by the UK government’s tone, many investors had held onto single market hopes as this firming stance from May is still being priced into GBP.

Euro (EUR) Movement Mixed Ahead of This Week’s ECB Meeting

Demand for the Euro improved slightly last week, thanks to a slew of optimistic Eurozone ecostats as well as a surprisingly hawkish minutes report from the European Central Bank’s (ECB) December policy meeting.

In the minutes it was detailed that not all ECB policymakers agreed that the bank’s controversial quantitative easing (QE) measures should be extended beyond March 2017.

This indicated to some traders that the Eurozone’s economic recovery may be nearing a point at which it no longer requires such drastic easing measures. Speculation that the ECB may wind back slightly on QE left the Euro stronger towards the end of last week.

However, investors became increasingly jittery about the upcoming inauguration of US President-elect Donald Trump this week, leading many traders to head towards ‘safe haven’ currencies. This limited the Euro’s gains against the Pound on Monday.

Pound Euro 2017 Exchange Rate Forecast to Drop Following Tuesday Brexit Speech

Theresa May will supposedly clarify the UK government’s aims for the Brexit negotiations for concerned citizens and markets.

Analysts predict the Pound will fall following the speech if May’s statements match reports claiming that she will announce the UK is to withdraw from the full single market in favour of increased immigration controls.

May is likely to reassert that her government will aim for the best possible post-Brexit deal for the UK and EU, but investors are unlikely to find reassurance in these words.

As Sterling has already fallen considerably in recent weeks from single market concerns, this reaction may have already been priced in, which could limit Tuesday’s GBP EUR losses.

Tuesday will also see the publication of the UK’s December Consumer Price Index (CPI) results, which are predicted to improve from 1.2% to 1.4% year-on-year. This is unlikely to offer Sterling considerable support, however, with single market fears in focus.

As for the Eurozone, ZEW will publish the results of its January economic sentiment surveys for the Eurozone and Germany. Wednesday’s German and Eurozone inflation results are also likely to influence movement in the shared currency.

The Pound Euro 2017 exchange rate is therefore expected to continue trending with a downside bias.